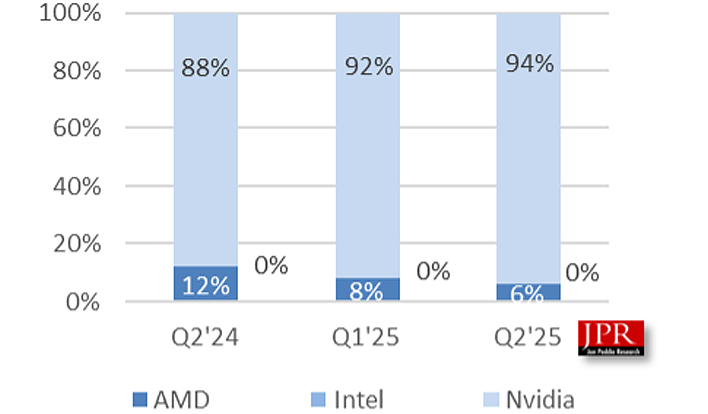

Nvidia's Discrete GPU Market Share Soars to 94%

Published on 15/09/2025

Nvidia's dominance in the discrete GPU market has reached new heights, with its market share now standing at an impressive 94% as of the second quarter of fiscal year 2025. This near-total control of the market has left competitors AMD and Intel struggling to maintain a foothold, with AMD's share dropping to a mere 6% and Intel's presence becoming virtually nonexistent.

The latest market analysis from Jon Peddie Research reveals a 2% increase in Nvidia's market share compared to the previous quarter, while AMD experienced a significant 6% decline. The reasons behind Nvidia's continued expansion are multifaceted, including its successful expansion into the burgeoning AI sector and the appeal of its high-performance GPUs for PC gaming.

Several factors have contributed to Nvidia's overwhelming market share:

1. AI Market Expansion: Nvidia's GPUs have become essential for AI and machine learning, areas where the company has a strong foothold. 2. Gaming Dominance: Nvidia's GeForce RTX series remains a popular choice for gamers, known for delivering high frame rates and advanced features like ray tracing. 3. Competitor Challenges: Intel's slow transition into the discrete GPU market and AMD's relatively limited offerings have hindered their ability to compete effectively.

While Nvidia's success is undeniable, its dominant market share raises concerns about potential impacts on consumers and the industry:

Higher Prices: With limited competition, Nvidia has greater pricing power, potentially leading to higher GPU prices for consumers. Reduced Innovation: A lack of competitive pressure could stifle innovation in the GPU market, potentially hindering the development of new technologies and features. Supply Chain Vulnerability: Overreliance on a single vendor for GPUs could expose the industry to risks from supply chain disruptions, notes TechInsights.

Despite the challenges posed by Nvidia's dominance, there are potential avenues for change: AMD's New Architectures: The launch of new GPU architectures from AMD, such as RDNA 4, could offer stronger competition and challenge Nvidia's lead. Intel's Growing Presence: Intel's entry into the discrete GPU market with its Arc series, while currently facing challenges, could gain momentum over time and become a viable contender. Emerging AI Chip Alternatives: The rise of alternative AI chip architectures, such as Google's TPUs and Cerebras' Wafer Scale Engine, could reduce the industry's reliance on Nvidia GPUs for AI workloads.

The coming years will be crucial in determining whether the GPU market can regain a more competitive landscape, benefiting both consumers and the broader technology industry.

Sources:

https://www.hpcwire.com/2024/06/10/nvidia-shipped-3-76-million-data-center-gpus-in-2023-according-to-study/

https://www.aol.com/articles/prediction-artificial-intelligence-ai-stock-104500169.html#:~:text=Nvidia%20controls%2070%25%20to%2095,estimated%20$4%20trillion%20by%202030.

https://hwbusters.com/freestyle/how-nvidia-shapes-global-markets-and-buyer-behavior-the-powerhouse-behind-the-ai-and-tech-revolution/#:~:text=Nvidia's%20dominance%20doesn't%20just,tech%20enthusiasts%20and%20global%20markets.

https://www.linkedin.com/pulse/return-lion-intels-path-compete-nvidia-rise-again-fahad-najam-nvu1c#:~:text=Intel%20is%20no%20longer%20the,to%20the%20most%20powerful%20comebacks.